Morgan McKinley Ireland Quarterly Employment Monitor IRISH PROFESSIONAL JOBS MARKET STEADIES AS CONFIDENCE RETURNS

AI adoption continues to accelerate

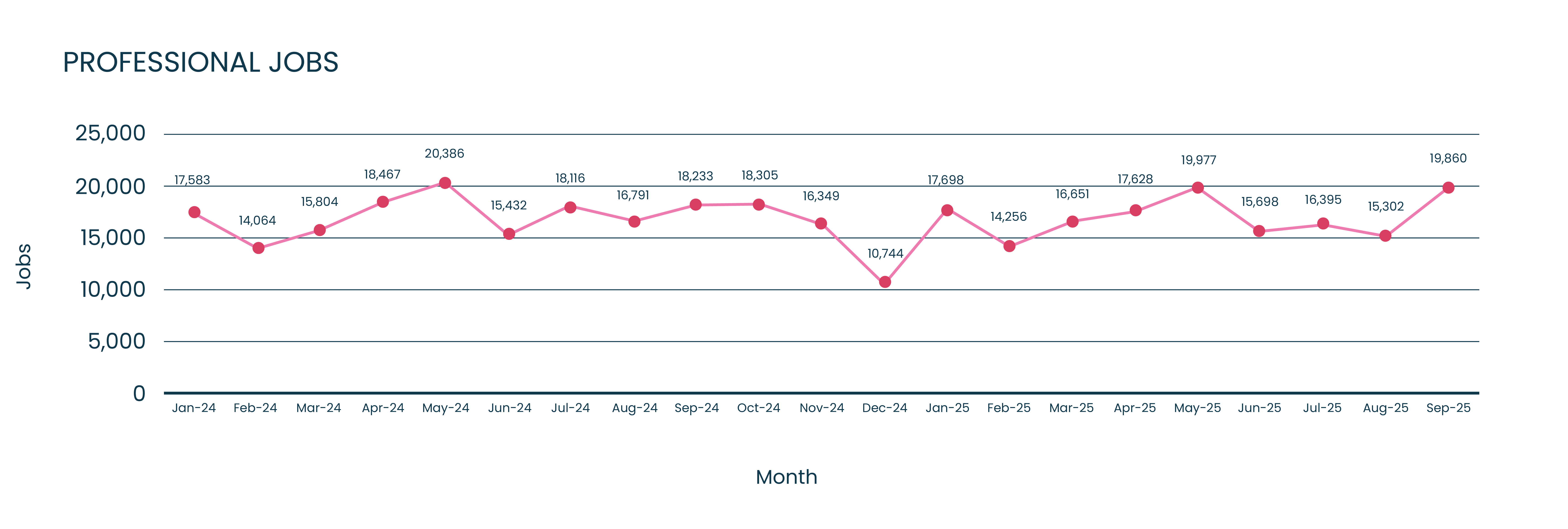

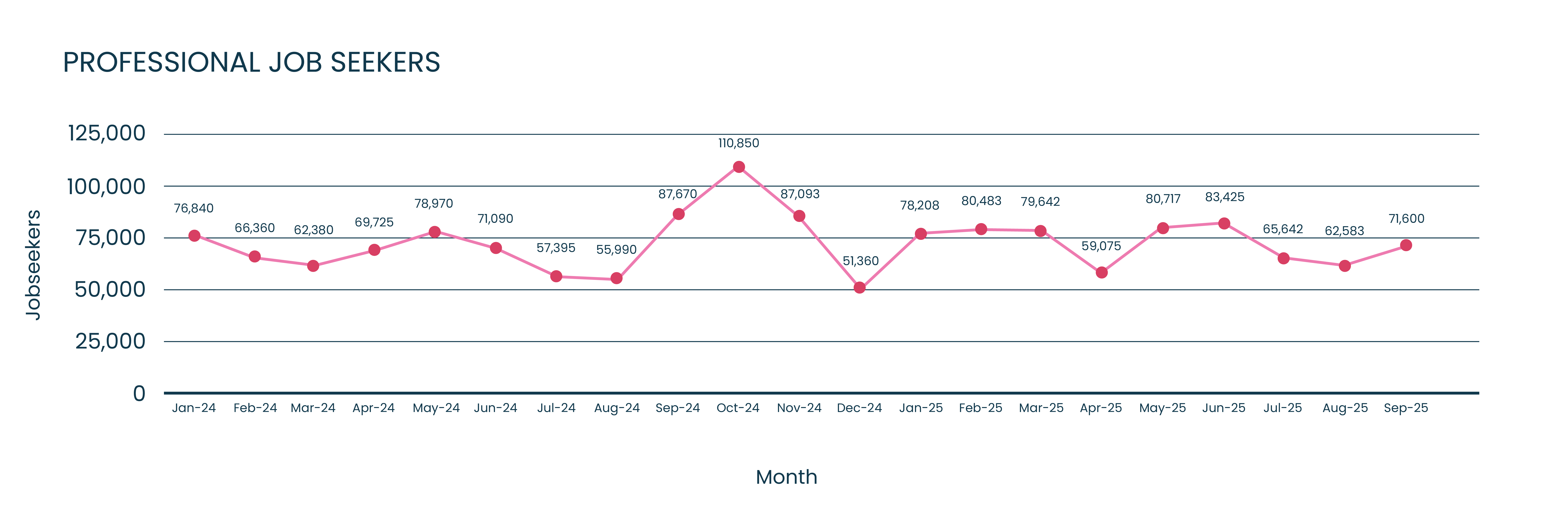

17th October 2025: The latest Morgan McKinley Irish Employment Monitor shows that professional job openings fell by 3% in the third quarter of 2025 compared with both the previous quarter and the same period last year, while the number of jobseekers declined by 10% quarter on quarter reflecting a typical summer slowdown and a period of more selective hiring.

Despite this moderation, the data points to a market that has stabilised rather than stalled. Confidence is returning as employers resume delayed projects, progress critical hires in strategic and transformation-focused roles and refocus on longer-term planning after a period of cost pressures and economic uncertainty.

Trayc Keevans, Global Foreign Direct Investment Director at Morgan McKinley, said: “Hiring cooled slightly over the summer, but confidence is returning across the professional jobs market. Employers are hiring more selectively, yet there’s growing appetite to plan ahead and invest in the skills that will drive productivity and transformation.”

“Digital capability remains the common thread. Whether through data analytics, automation or emerging AI applications, organisations are preparing for the next phase of change, but human expertise, adaptability and collaboration remain the foundation of success.

“Recruitment in the technology sector remained consistent as organisations continued to modernise systems, strengthen cybersecurity frameworks and expand their data and cloud capabilities. The strongest demand was for ERP specialists, cloud engineers, governance and risk analysts, threat-detection professionals and test-automation roles.

“While Dublin continues to lead overall hiring activity, there was a noticeable uptick in demand across the regions for software developers, data engineers, project managers, product specialists and UI and UX designers. Employers reported greater visibility on project timelines and budgets heading into Q4, suggesting continued confidence in Ireland’s technology labour market. AI and automation appeared more often in job specifications, particularly for data-driven roles, but they remain part of broader modernisation efforts rather than a standalone hiring trend.

“Recruitment across financial services was steady but selective, with activity concentrated in banking, insurance, funds and wealth management. In banking, there was strong demand for product managers and sustainability specialists as traditional institutions continued to develop new digital offerings and mobile apps to compete with fintech challengers. This quarter also marked the first time that newly established sustainability leadership positions appeared consistently across several institutions.

“Insurance employers continued to hire across underwriting, actuarial, claims and compliance functions as they invested in digital transformation and automation. Hiring in funds and asset management stabilised following earlier restructuring, with employers focusing on risk, governance and operational oversight roles. Wealth management and financial planning remained active as firms continued to consolidate advisory practices and plan for succession.

“Employers placed growing emphasis on stakeholder management and communication skills, which are now viewed as essential for senior progression. Salaries remained stable during the quarter, and there was a modest rise in contract and project-based roles as companies sought flexibility amid ongoing cost pressures and uncertainty around automation.

“Hiring across accounting and finance functions remained firm, supported by demand for commercially focused and analytically skilled finance professionals. Employers sought FP&A analysts and managers, finance business partners and qualified accountants with transformation experience.

“In Dublin, companies continued to recruit finance professionals capable of linking commercial performance to strategic outcomes. In the regions, employers increased hiring for financial accountants, payroll specialists, part-qualified accountants and accounts assistants. AI and automation are beginning to reshape transactional finance, particularly in larger organisations that are introducing new reporting and forecasting tools. Smaller firms continue to rely on manual processes due to implementation costs.

“The construction sector was one of the strongest performers in Q3, supported by public investment in infrastructure and sustained housing demand. Hiring was particularly strong for quantity surveyors, engineers, project managers and design staff. Much of the new work is linked to schools, hospitals, roads and rail projects currently in the design phase.

“Activity also increased in onshore renewables and solar developments, which are seen as more viable than offshore projects that remain cost prohibitive. By contrast, data-centre construction slowed due to a planning moratorium, prompting some mechanical and electrical contractors to seek projects elsewhere in Europe. Employers reported a steady inflow of talent, including experienced professionals returning from the UK and new arrivals from South Africa and India, particularly within the design sector.

“AI is being used selectively for preparing tenders and technical documentation but is not yet being applied to structural design work.

“In life sciences and engineering, hiring strengthened as employers advanced delayed projects following tariff-related uncertainty earlier in the year. Demand was strongest for validation, microbiology, quality and laboratory-systems specialists. Employers offered higher rates for short-term contracts to secure the right candidates while maintaining cost discipline. Inflation continued to influence salary expectations, and flexibility remained limited in on-site roles.

“Hiring in supply chain and procurement was steady but subdued. Employers focused on candidates with data analytics, lean manufacturing and automation experience to strengthen operational efficiency and manage costs.

“Hiring in human resources held steady in the third quarter as organisations focused on efficiency, retention and compliance. Demand centred on recruitment coordination, learning and development, employee relations and HR information systems, reflecting ongoing investment in data-driven HR functions. Employers continued to modernise systems and processes in preparation for the EU Pay Transparency Directive and to explore the use of AI for analytics and workforce planning. While salaries remained broadly stable, competition for skilled HR professionals is expected to intensify as companies adapt to new reporting and governance requirements in 2026.

“Marketing and legal hiring remained cautious as employers delayed discretionary spending and recruitment decisions. Marketing teams prioritised project management and agency coordination skills, while legal firms slowed recruitment due to postponed client projects.”

Current most in-demand positions by discipline:

Technology: Dublin: Java Developers, Test Managers, IT Support Engineers (Level 1–3), GRC Analysts, Threat Detection Engineers, ERP Specialists (SAP, Dynamics), Cloud Engineers (AWS, Azure). Regions: Azure Developers, Senior Software Engineers, Technical Leads, Product Owners, Project Managers, UI/UX Designers, AI Developers, IAM Engineers, Data Engineers.

Banking: Product Managers (Personal and Retail Banking), Heads of Sustainability, Sustainability Analysts and Managers, Credit and Mortgage Underwriters, Mortgage and Financial Advisors, Credit Analysts, Arrears Specialists, Internal Auditors, AML Officers

Insurance: Claims Assessors and Managers (Motor, Home, Commercial), Commercial and Personal Lines Account Executives, Corporate Brokers, Underwriters (Property, Casualty, Life), Risk and Compliance Specialists, Pricing and Reserving Actuaries, Product Managers, and Senior Leadership roles (Heads of Risk, Chief Compliance Officers, Heads of Underwriting).

Wealth Management: Wealth Managers, Financial Advisors, Paraplanners, Pensions Administrators, Employee Benefits Specialists.

Funds & Asset Management: Fund Accountant (Graduate to Director), Transfer Agency/Investor Services Specialists, Fund Operations Analyst, Middle Office and Oversight Professionals, Compliance Manager, AML/KYC Analysts, Risk and Regulatory Reporting Specialist, Portfolio Manager (Equities, Fixed Income, Alternatives), and Private Equity/Credit Analyst.

Accounting and Finance: Dublin: FP&A Analysts and Managers, Financial Accountants (1–3 PQE), Commercial Finance Analysts, Finance Business Partners, Tax Accountants and Managers, Audit Seniors, and Group Financial Controllers. Regions: Financial Accountants, FP&A Analysts, Practice Accountants, Accounts Assistants, Payroll Specialists, and Part-Qualified Accountants.

Life Sciences & engineering: Laboratory Systems Specialist, Site Microbiologist, QC Microbiology Analyst, Qualified Person, Project Engineer/Manager (Typically Mechanical), Validation Engineer/ Consultant, and Automation Engineer/ Consultant.

Business Support: Executive Assistant, Receptionist, Administrator, Multilingual Administrators (German/ Italian), and Senior Customer Service.

Human Resources: Recruitment Coordinator, HR Administrator, and HR Generalist.

Sales: Area sales manager, Business development manager, Technical Sales Engineer, Consultant sales engineer, and Growth account executive.

Construction Sector: Quantity Surveyors, Engineers (including Site Engineers, Mechanical, Electrical, and Civil Design Engineers), Project Managers (Construction and Mechanical/Electrical), and all Design Staff.

Supply Chain & procurement: Procurement/Purchasing Specialist, Planners, Buyers, Production Operators, Logistics Managers.

Marketing: Marketing Manager, Communications Manager, Marketing Executive, Events Executive, and Brand Manager.

Legal: Property Law, Corporate Law, Banking Law, Corporate Governance, and Commercial Legal Counsel.

Methodology:

- Monthly new jobs and new candidates:

Monthly new jobs and new candidate figures are based on Morgan McKinley’s monthly records of new permanent and contract job vacancies and new candidates registering with the firm for employment. Statistics for the full market are derived using Morgan McKinley’s market share. Effective November 2024, a recalibration of the job seeker calculation methodology has been implemented to reflect modifications in client vacancy advertising protocols. - Job classification:

Job vacancies are professional-level positions within the following sectors and functions: Legal, Funds, Technology, Admin/Office Support, Sales, Supply Chain and Procurement, Life Sciences, Executive Search, HR, Multilingual, Contract, Marketing, Banking and insurance, Accounting & Finance, and Projects/Transformation/Change. - Geography:

The data is based on new job vacancies and new candidates registered with Morgan McKinley’s network of Irish offices in Cork, Dublin, Galway, Limerick and Waterford.

Further press information: Sarah Lawlor, MKC Communications, 086 1904125

About Morgan McKinley

Morgan McKinley is a global talent services expert, offering the full spectrum of solutions to meet employers’ and jobseekers’ needs. With 19 offices in 10 countries and nearly 1000 employees, it provides 3 distinct solutions for customers. Morgan McKinley Recruitment Solutions encompassing deep expertise across 10 professional disciplines offering temporary, contract and permanent recruitment; Morgan McKinley Executive Search for targeted C-Suite talent searches; and Morgan McKinley Talent Solutions including RPO, MSP, Project Recruitment and more.

[gated-download-break title="Ireland Employment Monitor – Q3 2025" description=""]