Morgan McKinley Ireland Quarterly Employment Monitor IRISH PROFESSIONAL JOB VACANCIES RISE BY 10% IN Q2 2025

AI's rising impact drives shift in Ireland's professional jobs landscape

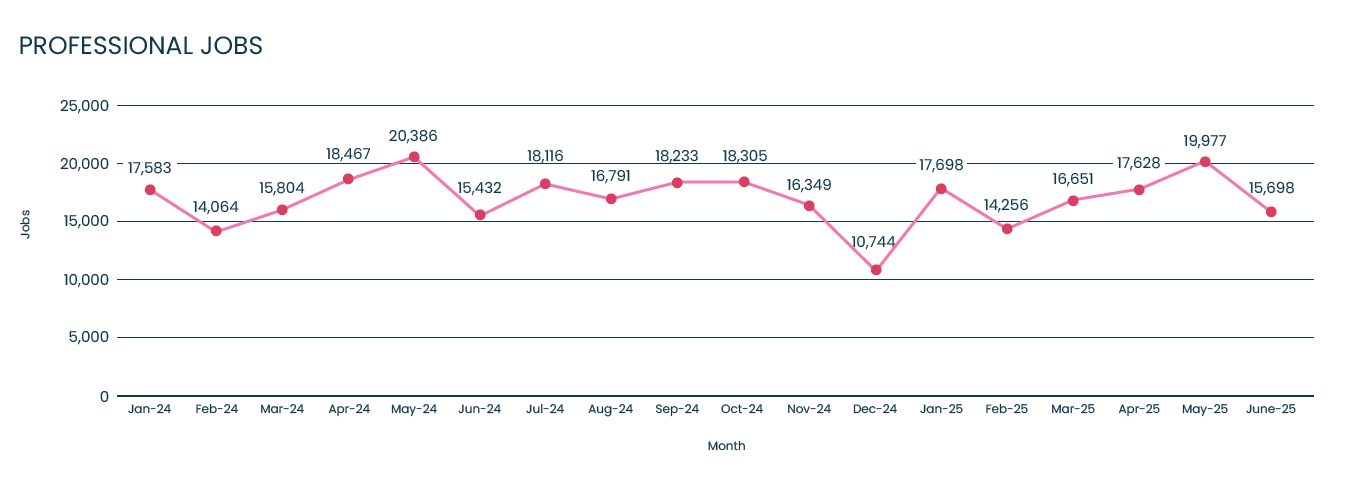

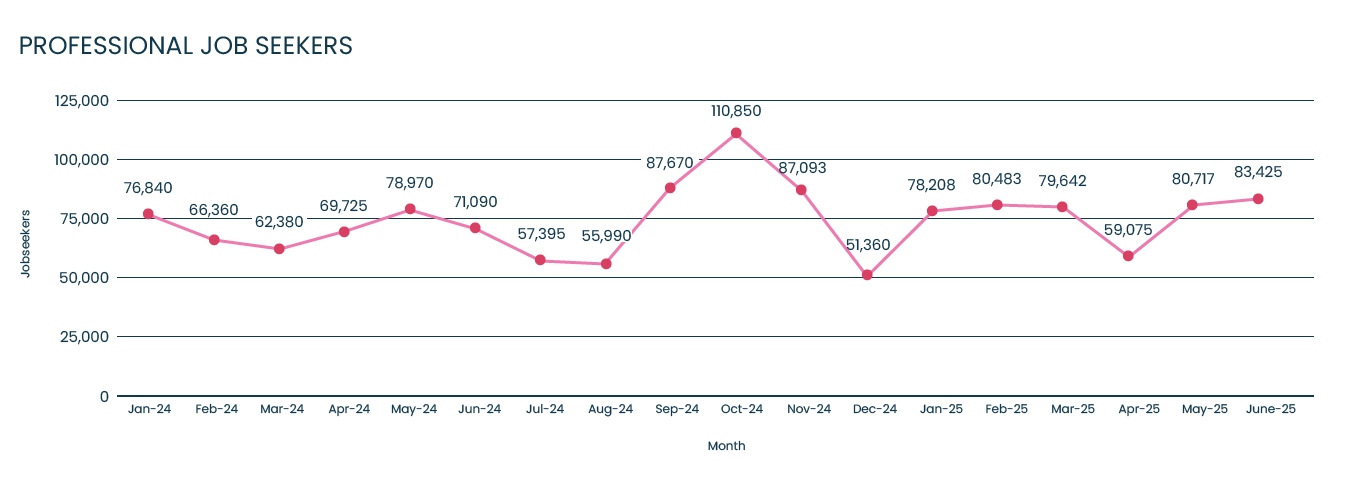

Thursday, 8th July 2025: Professional job openings across Ireland increased by 10% in the second quarter of 2025 compared to the previous quarter, according to the latest Morgan McKinley Irish Employment Monitor. However, the market remains cautious, with a slight year-on-year decline of 1.8%. Job seeker activity decreased by 6% from the first quarter but showed a modest year-on-year rise of 1.5%, indicating a resilient yet cautious employment environment.

Trayc Keevans, Global Director at Morgan McKinley Ireland, said: “The professional employment market in Ireland has shown steady resilience in Q2, despite external economic uncertainties and shifting global trade dynamics. The standout development this quarter is the significant impact of AI and automation, particularly within the accountancy and finance sectors. The notable reduction in graduate hiring by major firms, driven by AI capabilities, highlights potential challenges ahead. Additionally, ongoing debates around hybrid and return-to-office working models continue to shape recruitment strategies, as employers seek the right balance between flexibility and in-person collaboration.

“Ireland’s technology sector, particularly in Dublin, continues to see strong yet uneven hiring activity. Recruitment remains robust for cybersecurity specialists, driven by heightened regulatory requirements such as NIS2 and DORA, and businesses continue to invest strategically in cloud technologies and targeted digital transformations. Permanent roles, especially in data engineering, are notably active as companies build their infrastructure for broader AI integration.

“However, contract hiring among larger multinational firms has slowed this quarter, influenced by tighter cost controls prompting a shift towards permanent positions or offshore staffing solutions. Despite this moderation, certain specialist areas, particularly software engineering and DevOps within fintech and financial services, continue to rely heavily on contract hires to maintain flexible and agile project delivery.

“Financial services have maintained consistent hiring across funds, insurance, and banking sectors. Employers are particularly focused on roles requiring compliance expertise, including anti-money laundering (AML) and Know Your Customer (KYC). Relationship management positions also remain highly sought after due to the ongoing focus on client retention and service excellence. AI-related hiring in this sector is primarily connected to data engineering roles, where organisations are cleaning and structuring data ahead of more extensive AI implementations, rather than directly hiring for purely AI-focused positions.

“The accounting and finance sector is experiencing a significant shift towards data analytics and AI-driven roles. Companies are increasingly leveraging AI capabilities to automate routine tasks such as accounts payable, accounts receivable, credit control, and payroll. This shift is creating high demand for professionals skilled in tools like SQL and Power BI, particularly in commercial finance roles such as business partners and financial analysts. A notable trend driven by automation is the reduction in graduate-level hiring, raising concerns about potential shortages of experienced mid-level professionals, which could impact future business operations and growth.

“Life sciences and engineering roles remain stable, driven largely by increased automation and compliance requirements. Notably, automation manufacturing has grown significantly, with a 20% increase since the previous year, which has led to strong demand for specialised automation engineers. While direct AI adoption in role-specific recruitment remains limited, automation and technologically driven efficiencies continue to shape hiring trends. Employers in this sector are cautiously recruiting, influenced by ongoing external factors such as tariff uncertainties and the challenging housing market impacting talent acquisition.

“The legal sector has experienced moderate growth in hiring, particularly within industry-focused roles involving corporate governance and regulatory compliance. Recruitment decisions delayed earlier in the year are now moving forward. AI's direct impact remains limited, but the complexity of regulatory environments could eventually create demand for legal professionals with expertise in technology regulation and data compliance. At present, junior talent shortages continue to challenge employers, and international recruitment remains relatively low.

“Business support roles have shown increased hiring, particularly driven by the return-to-office trend, with strong demand for onsite co-ordination and administrative positions. However, AI is beginning to influence customer service roles, with automation tools handling routine queries, enabling customer service staff to focus on more complex, higher-value interactions. This shift suggests that AI adoption in this sector is gradually reshaping traditional customer support functions.

“Human resources recruitment has markedly shifted towards temporary and contract employment, reflecting employer caution amidst global economic uncertainty. Currently, cost management strategies remain a priority, influencing HR departments to maintain workforce flexibility.

“The construction sector remains under significant pressure, facing persistent shortages of skilled professionals, especially quantity surveyors and project planners. These gaps are amplified by external factors such as Ireland’s severe housing shortage, procurement bottlenecks, and intensified competition from higher-paying European markets, which continue to attract Irish talent abroad. Commercial and pharmaceutical construction sectors have experienced a modest slowdown, yet residential and national infrastructure projects, including transport upgrades, renewable energy initiatives, and data centre developments, remain robust. However, ongoing talent deficits and material procurement difficulties threaten to constrain future growth.

“Supply chain and procurement hiring remained stable, despite a cautious reduction in temporary positions due to economic uncertainty. Employers continue to prioritise roles demanding advanced analytical capabilities, particularly as data-driven insights become crucial for operational efficiencies. While direct AI integration into hiring decisions is still limited, the rising importance of AI-driven analytics points towards an emerging shift in strategic decision-making within the sector.

“Marketing hiring has moderately increased, primarily for permanent positions driven by organisational restructuring. Employers are increasingly flexible about industry-specific experience, valuing instead proven expertise and adaptable skill sets to fill critical marketing roles.”

Current most in-demand positions by discipline:

Technology: Dublin: Enterprise Architects, Solution Architects, Software Engineers, Data Engineers, Cyber Architects, Cyber Analysts (particularly with NIS2 and DORA experience). Regions: Data Engineers, QA Testers with accessibility experience, Technical Support, Systems Administrators, DevOps professionals, Security engineers, ERP analysts, AI Developers.

Financial Services: Fund Accountants (Private Equity), Relationship Managers, Claims handler, General insurance Advisor, Financial Advisor, Investment Analyst, Product Manager, Insurance Account Executive, New Business Commercial Lines, Personal Lines Executive, Client Services Executive, Compliance Officer, Head of AML/KYC, Risk Analyst, Head of Risk

Accounting and Finance: Dublin: Financial Planning & Analysis (FP&A) Analysts/Managers, Accounts Payable, Accounts Receivable (short term contracts), Newly Qualified Accountant, Financial Accountant (1-3 PQE), Accounts Payable, Tax Accountant, Tax Manager and Tax Director, Commercial Financial Analyst, Finance Business Partner. Regions: Financial Accountant, Finance Manager, Accounts Assistant, Payroll Specialist, Part Qualified Accountant

Life Sciences and Engineering: Maintenance Technician, Qualified Person (QP), Automation Engineer, QC Microbiologist, Maintenance Manager, Validation Engineer and Process Engineers.

Projects, Transformation & Change: Project Manager, Change Manager, Business Analyst, Program Manager, and Transformation Manager.

Business Support: Dublin: Executive Assistant/ Personal Assistant, Office Manager, Legal Secretary, Receptionist, Facilities Coordinator/ Manager. Regions: Clerical Officer, Customer Service, Receptionist, Administrator, Sales Administrator

Human Resources: HR Business Partner, Learning & Development (L&D), Talent Acquisition Specialist, HR Generalist, and Head of HR.

Construction: Quantity Surveyor, Mechanical Engineer, Electrical Engineer, Structural Engineer, Civil Engineer, Electrical & Mechanical Project Managers, Health and Safety Specialists/Managers, Architect.

Supply Chain & Procurement: Logistics professionals- mid level, Production Managers, Buyer/ Junior Procurement.

Marketing: Marketing Executive, Head of Marketing, Events Manager, Communications Manager, Paid Performance Specialist.

Legal: Corporate Solicitor, Technology Solicitor, Property Solicitor, Aviation Finance Solicitor, Company Secretary.

Methodology:

- Monthly new jobs and new candidates:

Monthly new jobs and new candidate figures are based on Morgan McKinley’s monthly records of new permanent and contract job vacancies and new candidates registering with the firm for employment. Statistics for the full market are derived using Morgan McKinley’s market share. Effective November 2024, a recalibration of the job seeker calculation methodology has been implemented to reflect modifications in client vacancy advertising protocols. - Job classification:

Job vacancies are professional-level positions within the following sectors and functions: Legal, Funds, Technology, Admin/Office Support, Sales, Supply Chain and Procurement, Life Sciences, Executive Search, HR, Multilingual, Contract, Marketing, Banking and insurance, Accounting & Finance, and Projects/Transformation/Change. - Geography:

The data is based on new job vacancies and new candidates registered with Morgan McKinley’s network of Irish offices in Cork, Dublin, Galway, Limerick and Waterford.

Further press information: Sarah Lawlor, MKC Communications, 086 1904125

About Morgan McKinley

Morgan McKinley is a global talent services expert, offering the full spectrum of solutions to meet employers’ and jobseekers’ needs. With 19 offices in 10 countries and nearly 1000 employees, it provides 3 distinct solutions for customers. Morgan McKinley Recruitment Solutions encompassing deep expertise across 10 professional disciplines offering temporary, contract and permanent recruitment; Morgan McKinley Executive Search for targeted C-Suite talent searches; and Morgan McKinley Talent Solutions including RPO, MSP, Project Recruitment and more.